This article can be found on the EnergyLogic website here.

Builder Confidence Climbs

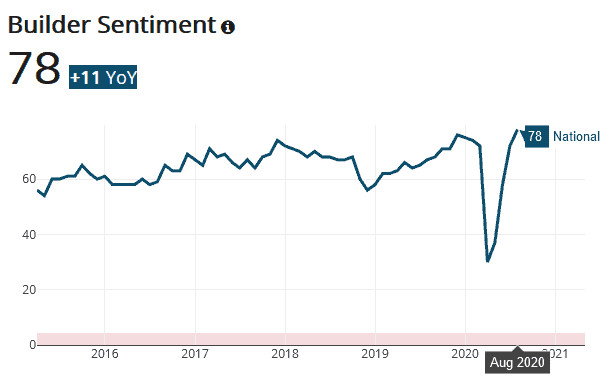

This monthly review of the sentiment of builders conducted by the National Association of Home Builders and Wells Fargo jumped to a record high in its 35-year existence. From July to August the index rose six points to 78.

Homebuilder sentiment shown in Housing Tides rises in August to a new multi-year high after a sharp decline in recent months.

This is a remarkable feat given that in March 2020 home builders faced a perilous future full of uncertainties. A precipitous drop was quickly followed by a sharp “V”-shaped recovery. This was a script that no industry expert could have written as the COVID-pandemic gripped the nation in March. Builders that were making disaster plans in April are now boasting that they expect to exceed business plans for 2020 if they can complete construction on all their sales. Most are raising prices in their communities. Mortgage interest rates are at historic low levels pumping up demand.

Builders were clearly benefiting from the severe shortage of existing home for sale. There were too few homes even before the pandemic struck, and now few homeowners are willing to put their home on the market. Evidence of this is found in Housing Tides with its monthly monitoring the resale market. The CARES Act passed earlier this year into law allowed for forbearance on foreclosures eliminating more potential housing inventory.

Tip! Housing Tides tracks home builder confidence monthly. We recognize this along with other important market indicators and industry variables that compose the Housing Tides Index™.

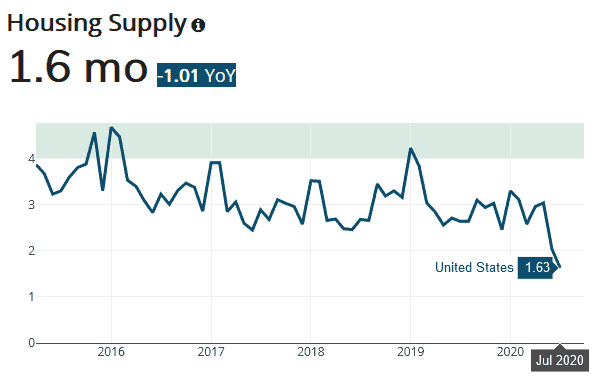

Extreme Shortage of Housing Supply

The National Association of Realtors announced this past week that housing supply of existing homes plummeted 21.1% annually, with just 1.5 million homes for sale at the end of July. This represents a 3.1-month supply at the current sales pace, down from a 4.2-month supply a year earlier. Per CNBC, it’s the lowest July supply in the history of the inventory survey, which has been tracking single-family housing supply data since 1982.

Housing Tides shows surprising strength in housing demand has resulted in the lowest level of supply in years.

That shortage drove the median price of a home sold in July up 8.5% annually to $304,100. This is a record high nominal price but also the highest price when adjusted for inflation. Redfin’s report is included in Housing Tides and presents the average resale price at $311,000.

The United States also has faced a housing shortage. Up for Growth, a housing research group, estimates from 2000 to 2015, 23 states under-produced housing to the tune of 7.3 million units (or roughly 5.4% of the total housing stock of the U.S.) which has created a supply-and-demand imbalance that is reflected in today’s home prices. Up for Growth also states that housing starts have not kept up with household formations since 2011.

Tip! This can also be studied in Housing Tides homebuilding permit forecasts which covers the 50 major U.S. housing markets in the U.S., monitoring permit issuance and permits per household data.

Restrictive Zoning & Policy Hinders Construction Growth

The current imbalance in housing supply and demand continues a longer-term trend that markets have experienced for decades — restrictive local development and land-use policies that reflect opposition to high-density, multi-family urban growth as well as yielding to NIMBY opposition. These policies also are a form of structural racism that has led to segregation and limit the benefits of home ownership for people of color. These policies include:

- Zoning restrictions, which create a shortage of zoned high-density sites.

- Escalating and misaligned fee structures, such as impact and linkage fees.

- Poorly calibrated inclusionary housing requirements.

- Lengthy review processes that invite gaming and abuse by growth opponents and that can delay projects, create unpredictability, reduce incentives to invest, and increase the per-unit of cost of development.

Tip! When using the Housing Tides Media Analysis within the interface, you can click on the real estate news activity within each selected market to see the effect of zoning issues on prospective housing projects.

Builder Are Optimistic, but Challenges Are on the Horizon

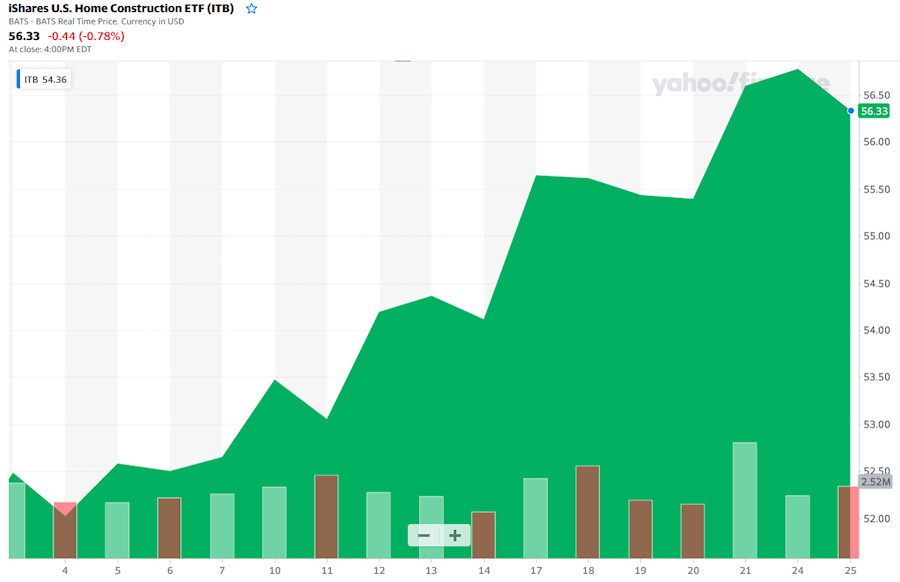

It appears that home builders have gotten out of the woods quickly on the COVID Recession. The public home builders are all enjoying a jump in their stock prices last week.

Yahoo! Finance graph of ITB index of public homebuilders, last 30 days.

Smiles are on their faces once again. The question is now, how long will these conditions be favorable? Will lumber and other commodity prices increase to new highs as well? Labor shortages and the inefficiency of working around COVID restrictions will continue to drag production and slow deliveries.

Tip! Keeping a close eye on construction cost trends by using Housing Tides can help provide greater confidence when making business decisions.

Outlook From an Industry Veteran

Builders are now in preparation of their 2021 business plans. From my forty-year experience as a home builder, I am sure that the builders will exude optimism. I hope that these plans include ways to increase the rate of minority home ownership, the best way to grow wealth and provide economic opportunity on an equal basis. Expose zoning restrictions and NIMBYism that have led to the severe housing shortage as an imbedded form of structural racism. Build more affordable housing by increasing density and lowering fees. Use down payment assisted programs and recalculate underwriting requirements for people of color.